Live Chat Software by Kayako |

Knowledgebase: Frequently Asked Questions

|

What are the different types of Forex brokers?

Posted by Homi .M on 22 November 2012 01:27 PM

|

|

|

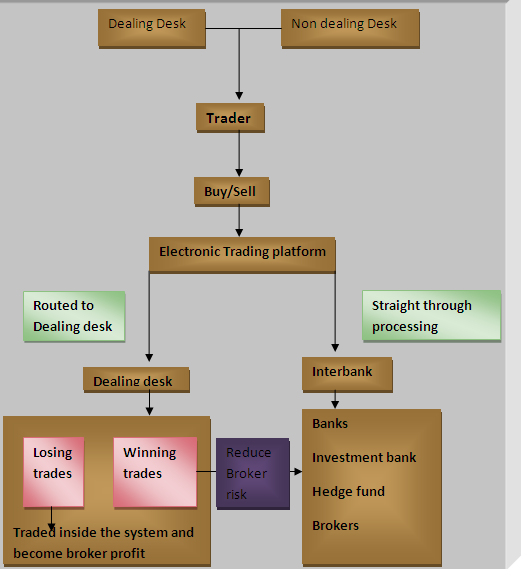

The types of Forex brokers: ECN - STP - NDD - DD

The spreads offered are lower, but they are not fixed, so they can increase significantly when volatility is increasing during major economic announcements.An NDD broker can either charge a commission on each trade or choose to increase the spread. STP - Straight Through Processing: In STP mode, transactions are fully computerized and are immediately processed on the interbank market without any broker intervention. ECN - Electronic Communication Network:ECN brokers provide and display real-time order book information (featuring the orders that were processed and the prices offered by banks on the interbank market).They thereby improve market transparency by providing information to all market participants. ECN brokers usually make their money by charging a commission on the traded volume.With ECN brokers, all transactions are directly processed on the interbank market in No Dealing Desk mode. | |

|

|

Comments (0)