Live Chat Software by Kayako |

|

What is Gap?

Posted by Homi .M on 02 May 2013 02:52 PM

|

|

|

A break between prices on a chart occurs when the price makes a sharp move up or down with no occurred trading in between. Gaps can be created by factors such as regular buying or selling pressure, earnings announcements, and a change in an analyst's outlook, during an adverse development of a financial/economic issue or any other type of news release. Forex gaps can happen at any time of the day as long as there is a disconnection of the price of the currency pair.

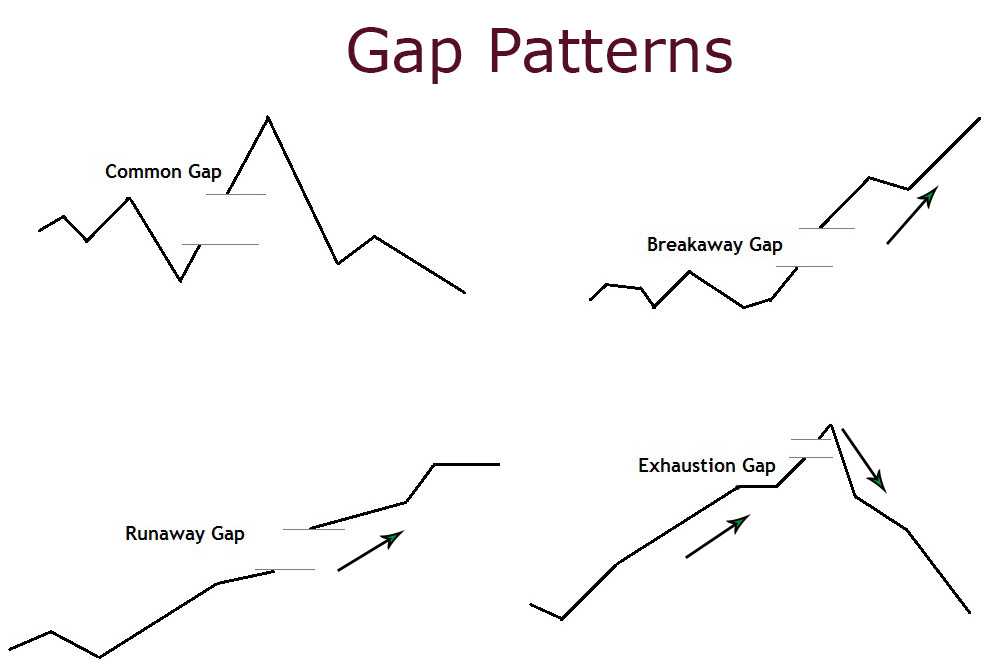

There are 4 types of gaps In Forex trading.

These gaps are brought about by normal market forces and, as the name implies, are very common. They are represented graphically by a non-linear jump or drop from one point on the chart to another point.

A breakaway gap represents a gap in the movement of a stock price supported by high volume levels.

A type of gap on a price chart occurs during strong bull or bear movements characterized by an abrupt change in price and appearing over a range of prices. They are best described as gaps caused by a sudden increase/decrease in interest for a stock.

A gap occurs after the rapid rise in a stock's price begins to tail off. An exhaustion gap usually reflects falling demand for a particular stock.

| |

|

|